- #Tax miles standard calculator driver#

- #Tax miles standard calculator manual#

- #Tax miles standard calculator professional#

In later years, they can choose either the standard mileage rate or the actual expenses. Rather than use the standard mileage rates, taxpayers may also calculate the actual costs of using their vehicle.ĭuring the first year the car is available for business use, taxpayers must use the standard mileage rate.

The rate for medical and moving purposes is based on the variable costs. These rates are based on an annual study of the fixed and variable costs for operating an automobile. This rate is set by statute and remains unchanged from the 2021 rate.

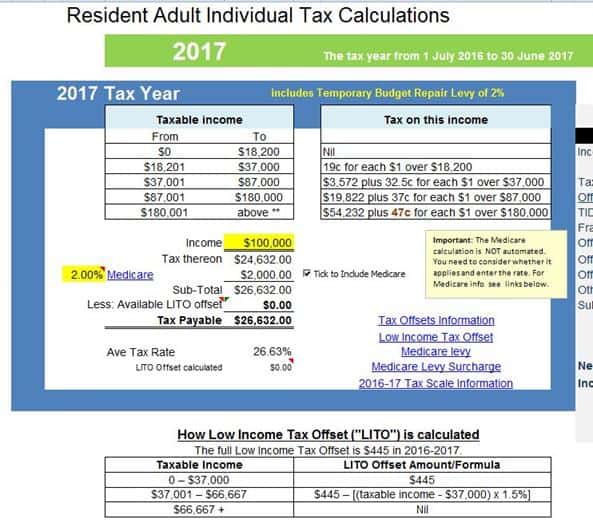

735 and add that total amount to your initial taxable income.

#Tax miles standard calculator professional#

That is for personal and professional purposes. Let’s do an example: Say you drove 500 miles in total in 2020. 4 fire departments within 10 miles - Cloverdale, Cal Fire, Hopland, Yorkville. The simple calculation is to divide your total number of miles by your business miles to get your business usage.

#Tax miles standard calculator driver#

Using these same figures to calculate the standard mileage rate deduction, the driver multiplies the business mileage (5,000 miles) by the standard mileage rate, for a standard mileage rate deduction of 3,025. Or turn right on Hwy 128 for a trip to the beach. Since the driver used the car for business purposes 50 of the time, the actual expenses deduction is 4,750 (9,500 x.

#Tax miles standard calculator manual#

If you want to find your reimbursement for 2021, you can use the explanation for the manual calculation above and apply the following rates instead: The IRS standard mileage rates for 2021 0.56 per mile driven for business 0. Or down to Cloverdale for a quart of milk. This business mileage calculator is set to use the standard rates for 2021. Mileage Reimbursement Calculator Tax Year How many miles did you drive during the year Business mi. Step 3 Optionally enter your miles driven for moving, charitable or medical purposes. 3 4 You have the option of claiming this or a percentage of your actual vehicle expenses instead. Step 2 Enter your miles driven for business purposes. The standard mileage rate deduction is 0.585 for the first half of the 2022 tax year and 0.625 for the second half. Head north on Mountain House to the Ukiah Costco, Friedmans, Safeway and other services. Mileage Reimbursement Calculator instructions Step 1 Select your tax year. About 1300' in elevation, it's about 10 degrees cooler than Cloverdale with an afternoon coastal breeze & little fog. There are two ways to calculate your mileage for your tax return: using the standard mileage rate or calculating your actual costs. Created to maximize the features of each parcel, one has already sold. This newly created subdivision is fully surveyed and staked. Wildlife, oaks, madrone and douglas fir trees. Room for horses, vineyard (Yorkville Highlands AVA), or? Use Mendocino County Class K for easy construction approvals? Zoning allows main home, a 1200sf accessory dwelling unit, guest houses and more! Family compound? Choose your house site to maximize views, privacy, usable land, or solar access for off the grid living. PG&E on property and high speed internet available. Permitted fully installed 3 bedroom standard system, and 22GPM well.

Easy access on paved roads only 7 miles from Hwy 101 and Cloverdale, 1.5 hours from the Golden Gate Bridge.

0 kommentar(er)

0 kommentar(er)